Unbundling of value streams

In recent years, the commercial banking landscape has undergone a profound transformation driven by technological advancements and the rise of digital business ecosystems. The commercial banking value chain, which was previously fused, has seen systematic unbundling over a period of time.

This unbundling has been propelled by technological innovations across digital touchpoints, cloud computing, artificial intelligence (AI), application programming interfaces (APIs), and blockchain. These advancements empower banks and fintechs to develop entirely new capabilities, products, and intelligent services. Secondly, with corporate customers increasingly shifting to digital platforms, there is a growing demand for real-time payments and integrated financing embedded within day-to-day operations. Traditional value chains are being unbundled to meet these evolving needs, creating more agile and responsive organizations. Fintech and big tech companies have seized the opportunity to address unmet needs in business by leveraging technology to disrupt traditional banking products and services.

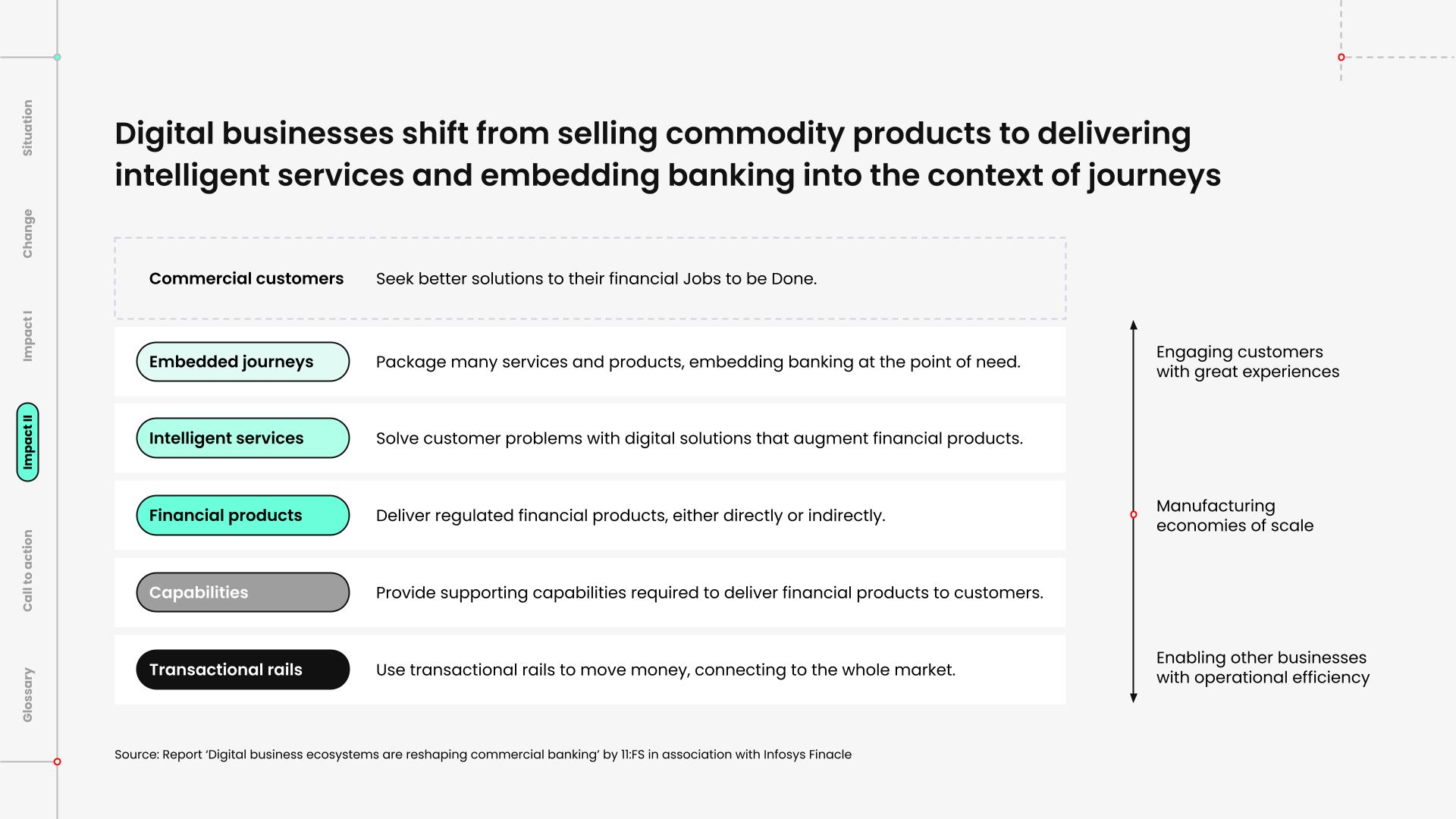

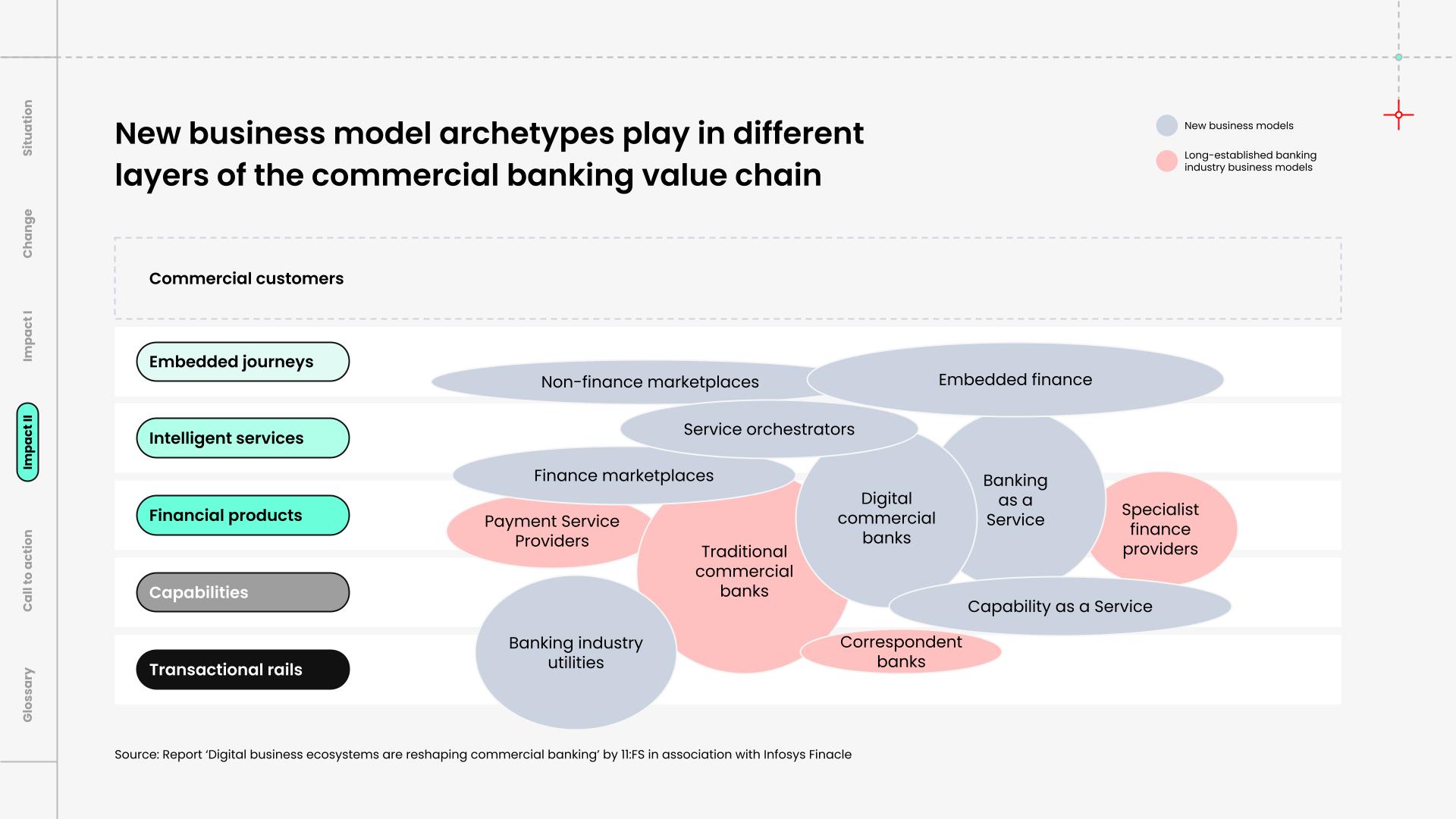

All this has led to a significant unbundling of the banking value chain as banks seek partnerships with fintech companies to access new technologies and capabilities. The result is a landscape where different players operate across layers of transaction rails, capabilities, financial products, and intelligent services.

Digital businesses, including fast-moving incumbents and fintechs, are quick to recognize and capitalize on the possibilities arising from the unbundling of value chains and provide businesses with more contextual, faster, and cheaper solutions. Like Lego blocks, these value stream components can be combined in myriad ways to create new business opportunities. Incumbent banks also seize this opportunity to identify and scale differentiation in specific layers. A bank, once required to operate across all layers, can now strategically decide which layers to build differentiation in and enlist specialized banks and fintechs for other layers.

Making strategic choices

Within this unbundled environment, digital businesses are strategically choosing specific layers to operate and differentiate themselves. For example, a digital business could decide to operate at the foundational infrastructure layer, providing utility services to banks and supporting capabilities (also to banks). An example here is ClearBank, a new clearing and agency banking platform in the United Kingdom in over 250 years, allowing banks and other customers real-time clearance on payment transactions. Players can act as a bank with its products and services, building economies of scale and managing their risks. Banks can operate above the product layer, offering intelligence services. An example is Stripe. Finally, organizations can play at the embedded journey layer where a big brand like Amazon or Uber embeds banking seamlessly within their services.

This strategic flexibility allows for the creation of new business models, such as digital commercial banks – an example being OakNorth Bank – which offers their services entirely over digital channels; capability-as-a-service providers offering specific capabilities, such as fraud detection, identity verification, payments processing (example Stripe or Razorpay), or securities custody, as a service to third parties, typically through APIs to enable easy integration; finance/non-finance marketplaces helping businesses procure financial services or goods and services from multiple third-party suppliers in an open environment; and banking as a service (BaaS) providers, such as Goldman Sachs, which offer complete banking processes, typically through APIs, that third parties can embed into their products and services.

With alternative commercial banking models proving their profitability potential, many incumbent banks are starting to experiment with them. For example, DBS Bank has established an industry utility for managing digital assets and set up non-finance marketplaces for SMEs. As these models prove their profitability potential, banks are scaling the ones that succeed, creating a diverse and dynamic commercial banking landscape.

Opportunities for specialization

While the current experimentation phase is crucial, it represents only the beginning of the evolution of digital commercial banking business models. As the industry matures, digital businesses will gain a deeper understanding of value streams, leading to more specialized variants. These may include embedded finance for specific industries like pharmacies, segment-focused financial companies, or providers of financial services exclusively to small physical shops.

One example of this specialization is Capchase in the US, which addresses the unique needs of SaaS start-ups by offering revenue-based financing and flexible payment solutions. The industry has immense untapped potential, and as it matures, we can expect a proliferation of specialized models that cater to specific niches.

The road ahead

Banks must embrace new business models to thrive in evolving ecosystems. To succeed, commercial banks must iterate relentlessly with customers to excel in the specific part of the value chain they deliver. The key to staying competitive lies in forging partnerships within digital business ecosystems. In these ecosystems, banks, fintechs, and other financial institutions can collaboratively create, deliver, and realize value for customers faster than their competitors. As the industry continues to evolve, those who adapt and innovate will not only survive but also lead the way in shaping the future of commercial banking.

About The Authors

Puneet Chhahira

Head – Product Management and Marketing, Infosys Finacle

Puneet is the co-head of product management and global head of marketing at Finacle - Infosys’s digital banking products unit that serves financial institutions in over 100 countries. Puneet has led multiple roles across consulting, startup engagements, and platform strategy during the last 17 years at Infosys Finacle. With his close collaborations with global banks, startups, and industry thought leaders, he brings along a deep understanding of the evolving financial industry landscape and how modern technologies can help unlock new possibilities. Before joining Infosys, Puneet was a regional business leader at Bajaj Allianz Life Insurance – one of the largest life insurers in India. Puneet holds an engineering degree in computer science and specialized in Marketing & Finance during his post-graduation.

Theo Albers

AVP & Head of Business – ANZ, Infosys Finacle

Theo heads the business for Infosys Finacle for the Australia and New Zealand market, supported by a team comprising of sales, business consulting, pre-sales, delivery and marketing. He comes with a strong technical background, and ample experience in complex multi stakeholder strategic delivery programs. From his many years of experience Theo has good knowledge of banking software functional capabilities, ability to design solution offerings and services to support customers strategic objectives by applying technology to address real world problems.

Theo heads the business for Infosys Finacle for the Australia and New Zealand market, supported by a team comprising of sales, business consulting, pre-sales, delivery and marketing. He comes with a strong technical background, and ample experience in complex multi stakeholder strategic delivery programs. From his many years of experience Theo has good knowledge of banking software functional capabilities, ability to design solution offerings and services to support customers strategic objectives by applying technology to address real world problems.