Square and Stripe, the international disruptors in Australia’s payments landscape, are the only payments processors doing the right thing by merchants, by enabling Least-cost Routing for (effectively) all merchants, Ellis Connolly, the Reserve Bank’s head of payments policy, told an industry conference yesterday.

“In our upcoming review, we are planning to ask whether a formal regulatory requirement is necessary for LCR” Connolly said.

“The RBA is focused on increasing competition in the debit card market to keep downward pressure on payment costs for merchants.

“This is particularly important since, with the decline in the use of cash for payments, debit cards are now used in half of all consumer transactions in Australia.

“For merchants to take advantage of LCR, payment service providers need to upgrade their systems to support it.

“To provide greater transparency on whether providers are getting this done, we have been publishing reports every six months on LCR availability and take-up across the major providers.

High-impact negotiation

masterclass

July 9 & 16, 2025

5:00pm - 8:30pm

This high-impact negotiation masterclass teaches practical strategies to help you succeed in challenging negotiations.

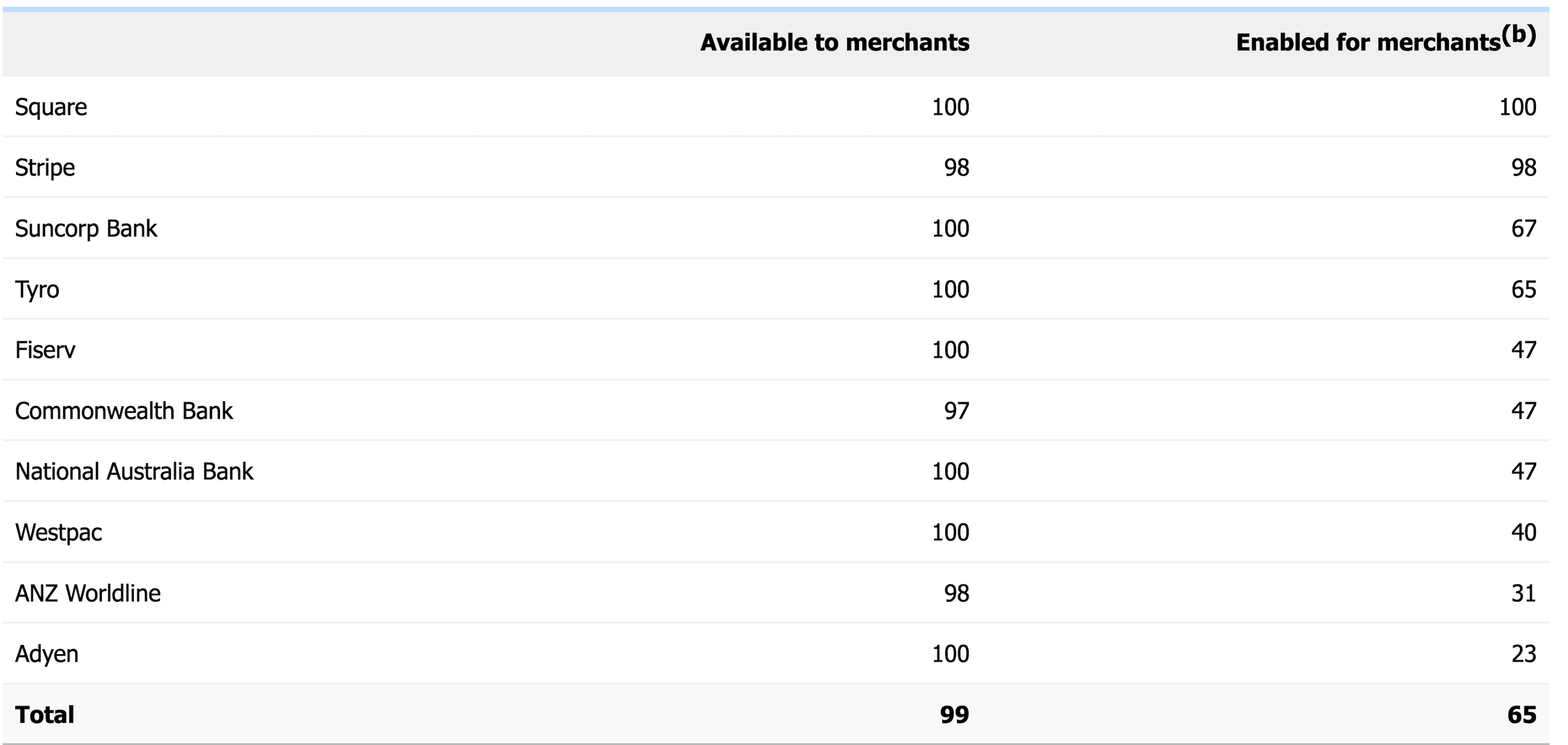

“By the end of 2023, the most progress had been made for transactions where a card is presented, where LCR was available to almost all merchants and enabled for 65 per cent of them.”

Being more diplomatic than the data calls for, Connolly said “while there is good progress across the industry, there is still more work for some providers to do.”

Least-cost Routing of Card-present Debit Card Transactions

Per cent of merchants, December 2023

Source: RBA

As the RBA data shows, the four major banks have LCR capability “available” but in in the case of all four banks none have even “enabled” LCR for at least half their merchants (as at December 2023).

In the case of ‘card-not-present’ payments, LCR is barely available at all. On RBA data, Wetspac had the capability “available” (as at December 2023) but had enabled it for no merchants. Commonwealth Bank had limited availability and managed to enable it for seven per cent of merchants.

“The next frontier for LCR is mobile wallet transactions, such as through Apple Pay and Google Pay” Connolly said.

“This is particularly important given the rapid growth in the use of mobile devices for in-person card transactions.

“We have been engaging regularly with the major mobile wallet providers and they are making good progress towards being able to support LCR for mobile wallet transactions by the end of this year.”

Connolly was speaking to the Merchant Risk Council Conference in Melbourne.