Trading conditions, at least for smaller businesses, are turning in parallel with the tightening of financial conditions.

The number of SME payments defaults is on the rise, while the number of economy-wide payments are on the slide.

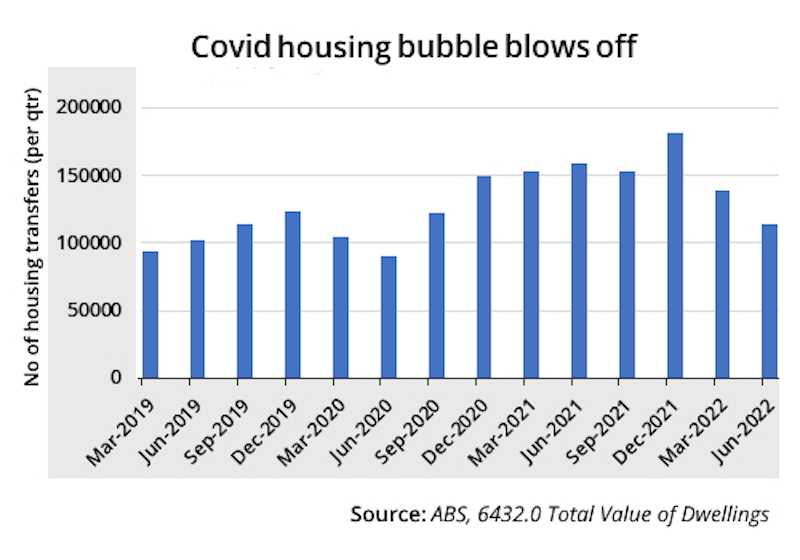

In the housing market, some may say things are clearly in a slump, taking the number of housing transfers as the measure.

“Trade payment defaults are surging - up 53 per cent year-on-year,” CreditorWatch reports in its Business Risk Index for August, released today.

“Our data continues to give us strong leading indicators that more small businesses are falling into distress,” CreditorWatch wrote in an overview.

Court actions “are up 51 per cent year-on-year and will continue to rise as the ATO ramps up legal actions,” they said.

High-impact negotiation

masterclass

July 9 & 16, 2025

5:00pm - 8:30pm

This high-impact negotiation masterclass teaches practical strategies to help you succeed in challenging negotiations.

External administrations were down nine per cent from July to August, but up 58 per cent year-on-year and 129 per cent since January.

Average trade receivables are at their second highest point since June 2021 and up 11 per cent year-on-year.

However, the Business Risk Index national default rate remained flat at 5.8 per cent in August.

CreditorWatch said it “continues to forecast a rise in business insolvencies across 2022 as multiple adverse impacts continue to batter the economy”.

RBA data on payments volumes and values shows the upswing in activity in the first quarter of the year is well and truly fading away, and that trend may be gathering pace.

Growth in (largely) P2P payments, by value, on the New Payments Platform have stalled.

The CBA Household Spending Intentions Index released yesterday portrays a mixed view of spending patterns in August, while highlighting “a weakness in discretionary spending in sectors like travel, entertainment, transport and retail”.

Meanwhile, ABS data on the number of housing transfers settled across Australia has well and truly turned, at least over the year to June 2022.

Meanwhile, ABS data on the number of housing transfers settled across Australia has well and truly turned, at least over the year to June 2022.

Given housing prices have blown off in the order of 15 per cent in major cities (on the more timely data compiled by Corelogic) it’s a fair bet these numbers on property activity will have worsened over the current quarter.

NCI Trade Credit Solutions yesterday cautioned clients: “the challenges are not isolated to building and construction. We are seeing casualties in hospitality and transport as businesses across a range of industries grapple with soaring inflation and rising interest rates.

“We expect many will not survive the bleak economic outlook – especially with the ATO intensifying collection activity on unpaid tax debt/s that runs into the billions.”