Source: KPMG

The average cost to income ratio increased by 336 basis points across Australia’s four major banks in FY2024, to 49.2 per cent, analysis by KPMG found.

This is in line with the overall increase in total operating expenses by 5.3 per cent to $44.0 billion, KPMG said, driven by inflation on core expenses such as personnel, offset by a decrease in investment spend.

Over the past 12 months, the total headcount for the major banks increased by 0.8 per cent, and personnel expenses increased by 3.5 per cent to a total $25.4 billion.

“While overall investment spend decreased by 0.7 per cent, which reflected the completion of several large programs, technology expenses increased significantly by 15.2 per cent to $8.9 billion” KPMG said.

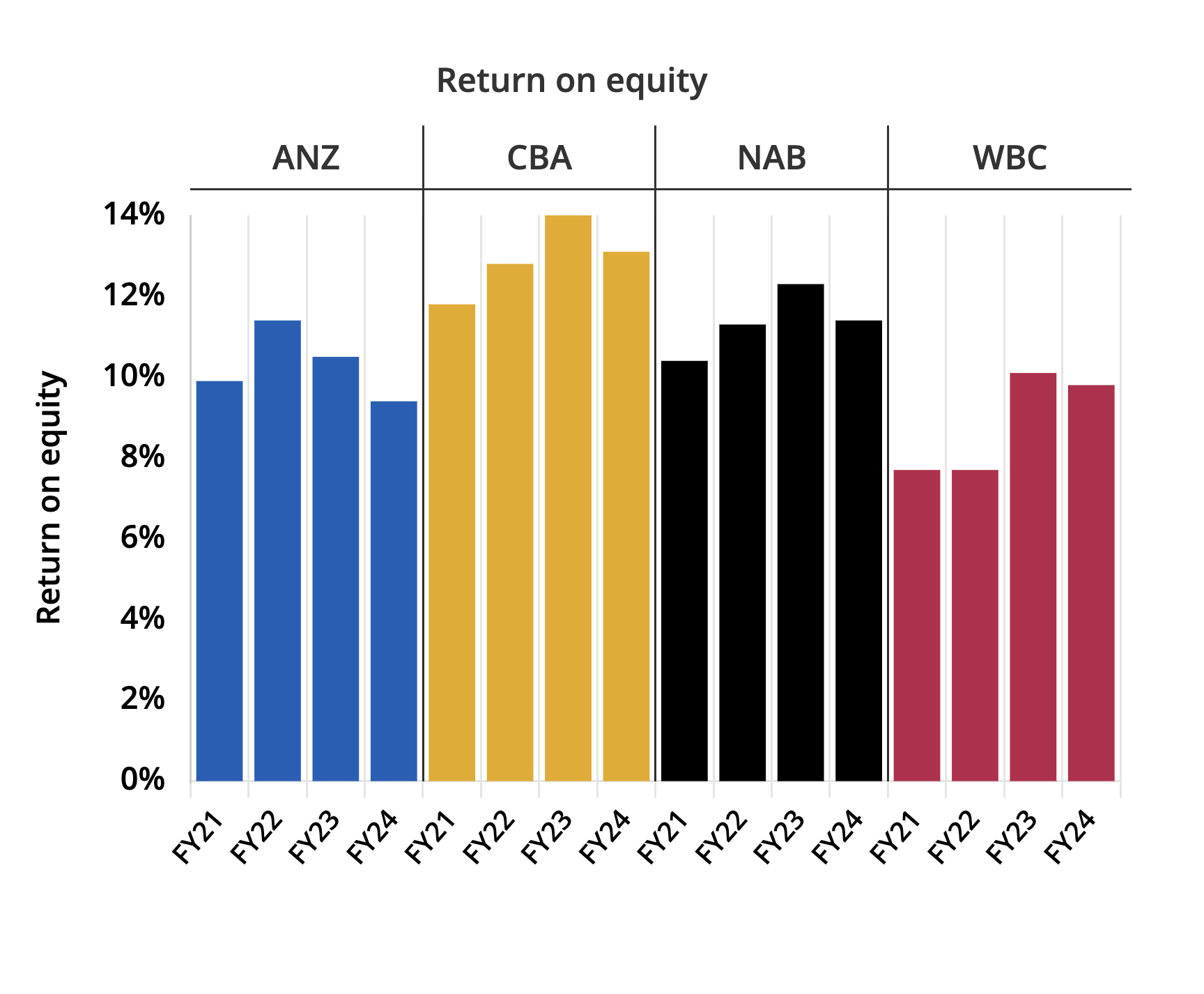

Major banks reported a combined profit after tax of $29.9 billion, down 5.7 per cent compared to FY2023.

Average net interest margin for the major banks was 180 basis points, a decrease of 7 basis points from FY2023.

High-impact negotiation

masterclass

July 9 & 16, 2025

5:00pm - 8:30pm

This high-impact negotiation masterclass teaches practical strategies to help you succeed in challenging negotiations.