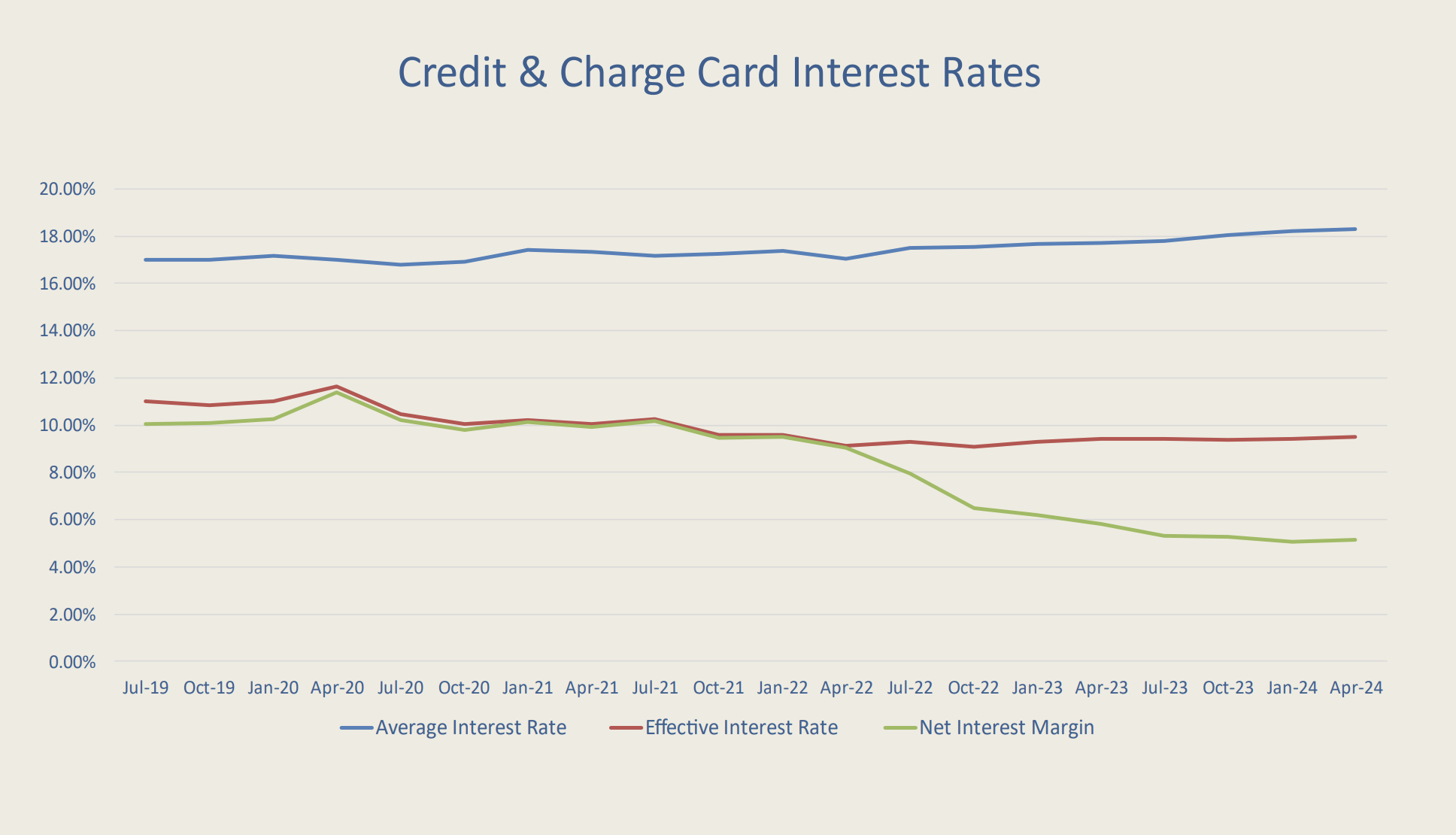

Source: MWE Consulting analysis of RBA data

The net interest margin earned across the totality of all credit card and charge card businesses is a shadow of what it once was.

Analysis by Mike Ebstein from MWE Consulting of RBA payments data has concluded that “a relatively steady, ‘sticky’ average interest rate on credit and charge cards, accompanied by a declining revolve rate and an increasing funding cost has seen the net interest margin almost halve over the last five years.”

MWE calculated an ‘effective rate’, beginning with the average rates applied to personal credit and charge cards as monitored by the RBA, then adjusting this for the overall average by the share of balances that actually accruing interest.

“This has reduced by 1.5 percentage points over the last five years” Ebstein told clients in his monthly Australian Payments Card Report. This analyses the monthly payments statistics from the RBA, released yesterday.

Paired with the seemingly unstoppable decline in the revolve rate – that is, credit card balances accruing interest – it is evident the earnings of the cards businesses of banks are being challenged.

The average annualised revolve rate decreased to 44.9 per cent in May 2024, the MWE analysis shows, down from 45.0 per cent in April and way, way down from a revolve rate of 75 per cent many years ago.

High-impact negotiation

masterclass

July 9 & 16, 2025

5:00pm - 8:30pm

This high-impact negotiation masterclass teaches practical strategies to help you succeed in challenging negotiations.