'The economy has stalled' says Anneke Thompson, chief economist at CreditorWatch

The finance sector in Australia “will see a decline in confidence soon”, in tandem with retail, housing and construction, Anneke Thompson, chief economist at CreditorWatch told an industry webinar yesterday.

Speaking soon after the ABS published its latest reading on the unemployment rate – at an almost unheard of modern low of 3.5 per cent – Thompson said the firm’s latest Business Risk Index, for June portrayed an economy that, “since January, picked up – but this month has stalled.

“There’s a bit of gloomy news this month, and this quarter,” she said.

“Business conditions, from business receivables data, are still above average, but I note business confidence (as reported by Westpac) is falling faster.

“While business conditions are still slightly better than the long-term average, our June data is pointing to the start of a deterioration in conditions.

“Businesses will be increasingly wary of their credit customers and their ability to pay going forward, even if no problems have arisen to this point.”

“Trade among small businesses is starting to ease. The retail sector is starting to prep for a tough second half of the year, anticipating they might see some [adverse] changes in the employment market around them.

“And housing, we’re seeing that start to decline significantly.

“We expect that the slowdown in housing market activity will impact businesses reliant on transactions in this sector, such as mortgage brokers, conveyancers and credit providers,” Thompson said.

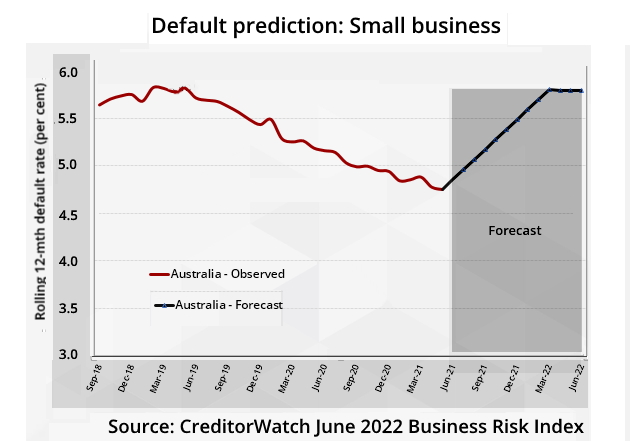

Business default rates “are rising on average in Australia, and we expect to them peak at around 5.8 per cent over the next 12 months,” CreditorWatch said in the Business Risk Index.

The firm has a probability of default in the finance sector of 4.5 per cent, and presumably it will be brokers and financial planners most at risk of falling over, rather than lenders.

The average probability of default is most severe for the pandemic-stressed hospitality sector (at 7.1 per cent), followed by the arts, education and transport – the latter (along with construction) being sectors that when troubled are classic leading indicators of a severe slump.

“We note that there is upside risk to this forecast, as we won’t see the full impact of interest rate rises, plus higher labour costs, until around October/November,” CreditorWatch said.

“We continue to see a disturbing rise in trade payment defaults, our leading indicator for future business insolvencies.”

Court actions are also back to pre-COVID levels, reflecting that banks “are back to their regular collection activity after the ‘loan holidays’ that they provided during the peak of the pandemic.

“Trade receivables and credit enquiries are down month-on-month, indicating that business confidence is at a turning point.

“Credit enquiries dipped marginally from May to June but are still up eight per cent year-on-year.”