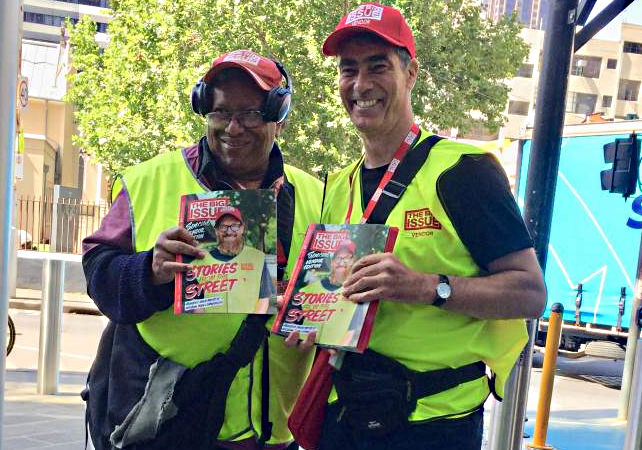

Street hustler and ME CEO Jamie McPhee (R)

After more than 30 years in the retail banking caper, outgoing ME Bank chief executive Jamie McPhee says he is not sure whether he will make a return to the industry.

McPhee, 55, yesterday announced his resignation which takes effect at the end of the month.

Chief financial officer Adam Crane will take the reins of the bank in an acting capacity while the board conducts an apparent search for a permanent replacement.

When asked whether he had a new executive role in the offing, McPhee said:

“Yes, there is a role. The role is to do nothing for some period of time. I’ve been working in banks for 30 years. When I finished after 20 years at Bendigo and Adelaide Bank on a Friday in 2010 the following Monday I started work at ME. It’s time for a break.”

McPhee’s imminent departure comes amid intense speculation that his board and the bank’s industry super fund shareholders have stuck a “for sale” sign on the business.

One shareholder told Banking Day that Macquarie was now advising the board on strategic options for the company.

The recent reputational fallout from the bank’s controversial attempt to curtail the redraw limits of 20,000 home borrowers appears to have been a catalyst for big shareholders such as Australian Super and HESTA to review their investments in the company.

Some industry funds have not always been glued to the idea of owning a bank.

At the peak of the global financial crisis in 2008 ME found itself exposed to a funding crisis because of its then heavy reliance on securitisation.

The Herald-Sun reported at the time that the funding pressures drove former ME chairman Bernie Fraser to approach Bendigo Bank’s board to test its interest in a potential merger.

Whatever plans may have been hatched during those meetings, they were dashed when the Rudd Government announced a guarantee on retail deposits and opened new funding lifelines for small ADIs such as ME.

In 2020, another narrative appears to be unfolding with Bendigo again in the frame as the front-runner to acquire ME’s balance sheet.

In an interview with Banking Day yesterday, McPhee straight-batted most questions despite the heavy industry talk that a sale of ME was in the works.

“I think the bank is in really good shape,” he said.

“It has a strong balance sheet and it is coming off a great year in terms of profitability.

“The timing is right for me and it’s right for the bank.”

Despite the backlash from customers over the redraw fiasco in May, McPhee said the bank’s performance in the 12 months to the end of June would show an improvement to the bottom line.

McPhee can claim credit for growing ME into a more sustainable business since he took over in 2010.

During his tenure the asset base increased by 50 per cent to around A$30 billion and customer numbers more than doubled to 542,000.

McPhee acknowledges that these outcomes might not have met the company’s publicly stated growth targets.

Six years ago he told Banking Day that ME was aiming to build a base of 1 million customers by 2020.

“I know I said that at the time but internally those targets were adjusted as we simplified our product range to focus on mortgage lending,” McPhee said yesterday.

“As we pared the products back to focus on home loans that target became unattainable.”

Achieving a 10 per cent return on equity has been a holy grail for some of ME’s shareholders since the business was launched almost 30 years ago.

While McPhee never managed to hit that target, he has been inching towards it for most of his time at the bank.

The four years up to the end of June 2018 was a period of consistent growth for the bank on most performance measures – retail deposits, mortgage lending, bottom line profit and returns on equity.

ME posted a record profit of $89 million in 2018, which equated to a return on equity of around 8.3 per cent.

These returns might have been greater had ME not been required to comply with APRA’s sector-wide caps on mortgage lending to investment borrowers.

McPhee rejects the suggestion that he was under severe pressure to crack the double digit ROE benchmark.

“It has been an objective, but I’m not sure I would use the word ‘pressure’,” he said.

“The bank has never been about maximising shareholder returns but it has been about achieving reasonable returns.”

It could be argued that in strategic terms one of McPhee’s biggest achievements was the expansion of the bank’s household deposit base, which doubled to $8.6 billion in the four years to June 2018.

McPhee established ME as a near-full service personal bank that could consistently raise new deposits.

Apart from reflecting increasing customer trust in the bank and its brand, it also remedied a longstanding weakness in ME’s funding profile - its heavy dependence on securitisation.

Given the existential threats that securitisation posed during the GFC, the strategic value of recent deposit boom at the bank cannot be understated.

McPhee is also accountable for strategic missteps that were costly for the bank.

ME was forced to take a $20 million write-down in 2019 after it abandoned plans to expand its credit card business.

Midway through the rollout of the program, the bank’s management realised that the buy now pay later revolution had rendered the project uneconomic.

This contributed to a 25 per cent fall in net profit to $67 million for the 12 months to the end of June last year.

Perhaps McPhee’s most important decision was implemented only months after he became CEO in 2010.

The withdrawal from business lending meant the bank sacrificed some high margin business to de-risk its loan book.

At the time it was a courageous decision.

While the value of the move might be lost in time, the legacy is that ME has no SME book to worry about in the current economic crisis.