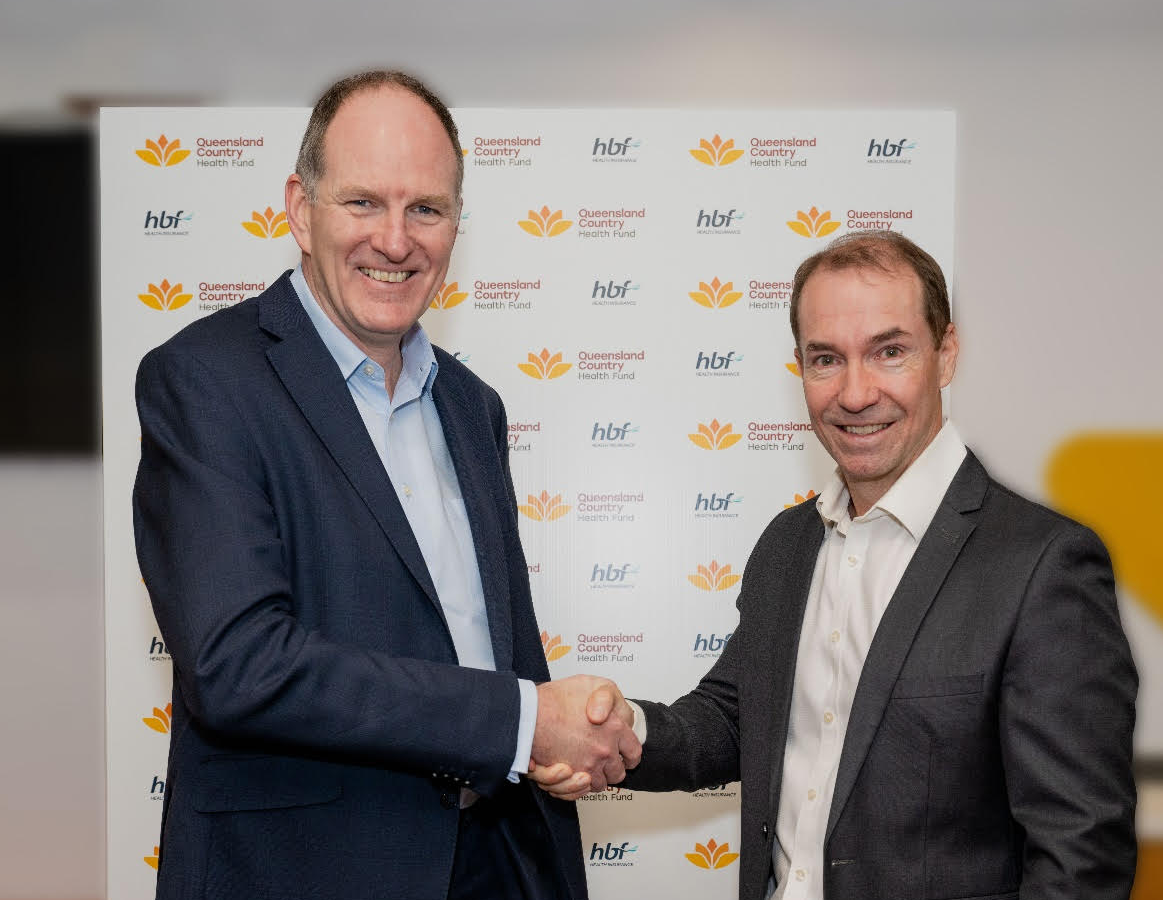

Simon Walsh, interim CEO, HBF (L) and Aaron Newman, CEO, Queensland Country Bank

Queensland Country Bank has agreed to sell Queensland Country Health Fund to WA-based HBF, Australia’s second largest not-for-profit health insurer.

Terms of the sale were not disclosed.

The bank’s CEO Aaron Newman said yesterday that the bank “made inquiries” with HBF following the sale by Great Southern Bank of CUA Health to HBF in late 2021.

“The success of the CUA Health acquisition was a key driver in our decision to join HBF,” he said.

QCHF has around 70,000 members. It was founded in Mt Isa in 1977 as the MIM Employees' Health Society. In 1999, the fund merged with Queensland Country Credit Union.

Today the health fund is headquartered in Townsville. QCHF’s workforce of around 100 will be offered continued employment at HBF at their current locations.

“The terms will eventually be disclosed, through the annual report,” Newman told Banking Day.

Since CUA Health had around 79,000 members – broadly the same as QCHF’s members – it’s tempting to wonder if HBF might have agreed to pay Queensland Country Bank something in the vicinity of the A$134 million pocketed by GSB.

The sale will undoubtedly release a material amount of capital for the mutual bank, which had $200 million in capital at June 2022.

QCB had around $2.9 billion in assets at September, and is the 14th largest mutual bank by assets.