Source: CreditorWatch

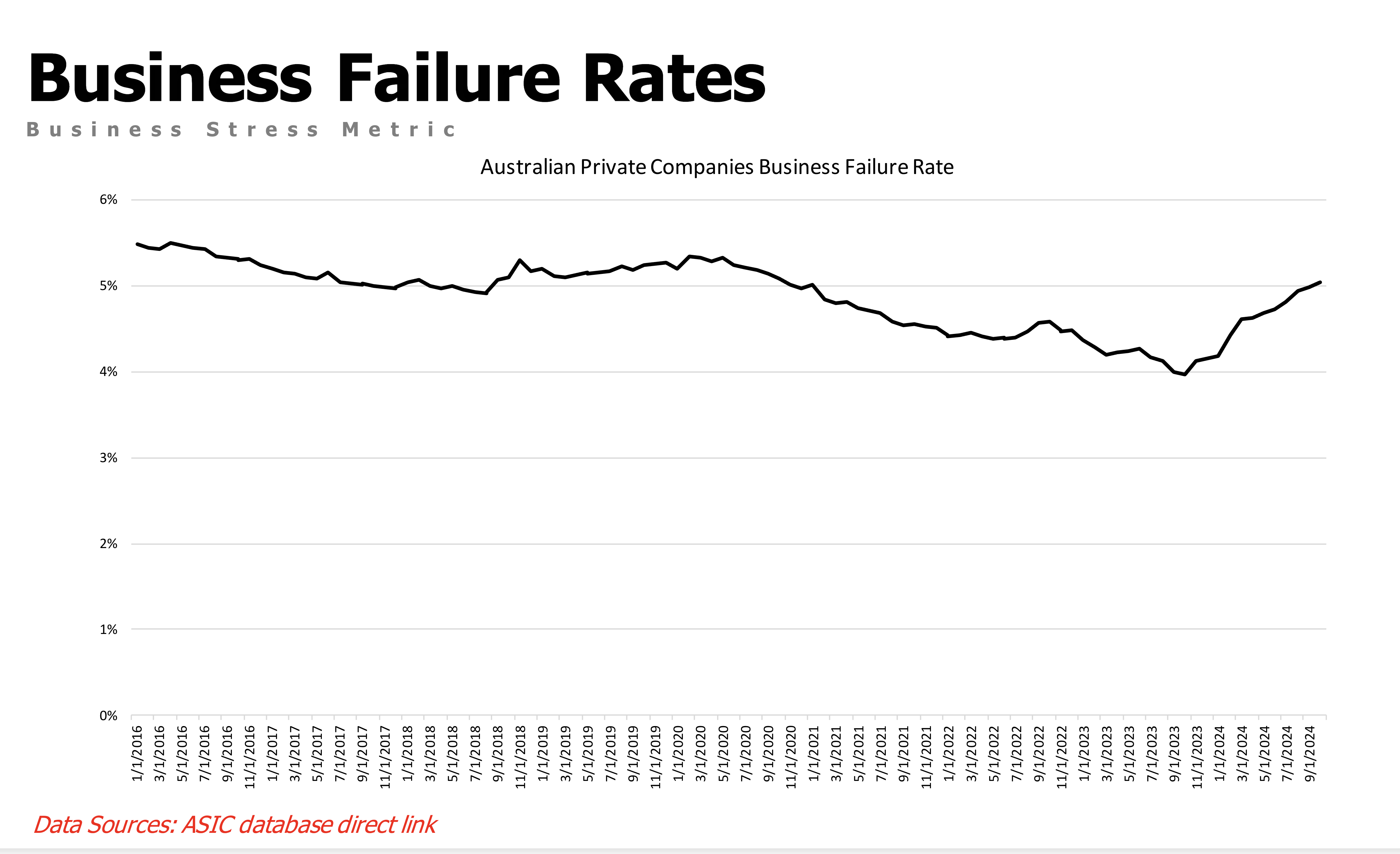

The average failure rate for Australian businesses sits at 5.04%, having climbed from 3.97% in October last year. The previous high was 5.08% in October 2020, credit reporting bureau, CreditorWatch said in its latest Business Risk Index.

business failures are now at the highest rate since the height of the COVID-19 pandemic in October 2020.

Higher prices and interest rates have increased the cost of living for consumers and the cost of doing business for companies, CreditorWatch said.

The ATO also recommenced collection activities at that time to attempt to recover some of the $35 billion in outstanding debt owed to it by small businesses.

CreditorWatch chief economist, Ivan Colhoun says businesses are experiencing many of the same cost pressures as consumers such as higher electricity, insurance and rental costs, as well as the impacts of minimum wage increases.

“Together with some greater caution in discretionary spending and softness in interest rate sensitive sectors of the economy, this unsurprisingly has led to higher voluntary business closures and some rise in insolvencies,” Colhoun said.

High-impact negotiation

masterclass

July 9 & 16, 2025

5:00pm - 8:30pm

This high-impact negotiation masterclass teaches practical strategies to help you succeed in challenging negotiations.

Food and beverage recorded the highest failure rate of all industries in October, increasing to 8.5% on a rolling 12-month basis from 8.3% in the 12 months to September. CreditorWatch’s 12-month forecast is for the failure rate in the sector to rise further to 9.1%.

Administrative and Support Services ranked second (6.0%) for the failure rate in October, followed by Arts and Recreation Services (5.9%) and Transport, Postal and Warehousing (5.8%).

“Interestingly, the failure rate in construction (5.3%) may be levelling out” CreditorWatch said.

“All sectors have seen a pickup in business failures since the step-up in ATO collections activity beginning in October 2023.

“Prior levels were therefore unrepresentatively low, while current rates may be a little overstated to the extent they reflect some bunching of failures that probably would have occurred at an earlier date.

Business insolvencies and loan arrears are still increasing. Annualised insolvency rates have more than doubled over the last 18 months.

CreditorWatch said it now has 28,780 records of businesses with overdue tax debts of more than $100,000, with sole traders comprising 50 per cent of these.