WIB chief Nell Huttton. In the frame to replace Peter King

The steady and meaningful rebuild of its market share over the last year or so – seemingly against the odds – is translating into a gentle recovery in the profitability of Westpac.

Net profit in the June 2024 quarter was $1.8 billion, steady with the March quarter and up from a profit of $1.5 billion in the December 2023 quarter, the quarterly trading update yesterday for the bank shows.

Net operating income of $5.4 billion in the June quarter follows net income of $5.0 billion and $5.5 billion in the December and March quarters.

Operating expenses were two per cent higher in the latest quarter. Round the numbers for a minimalist slide and expenses

Crucially, Westpac has stabilised its net interest margin over the quarter.

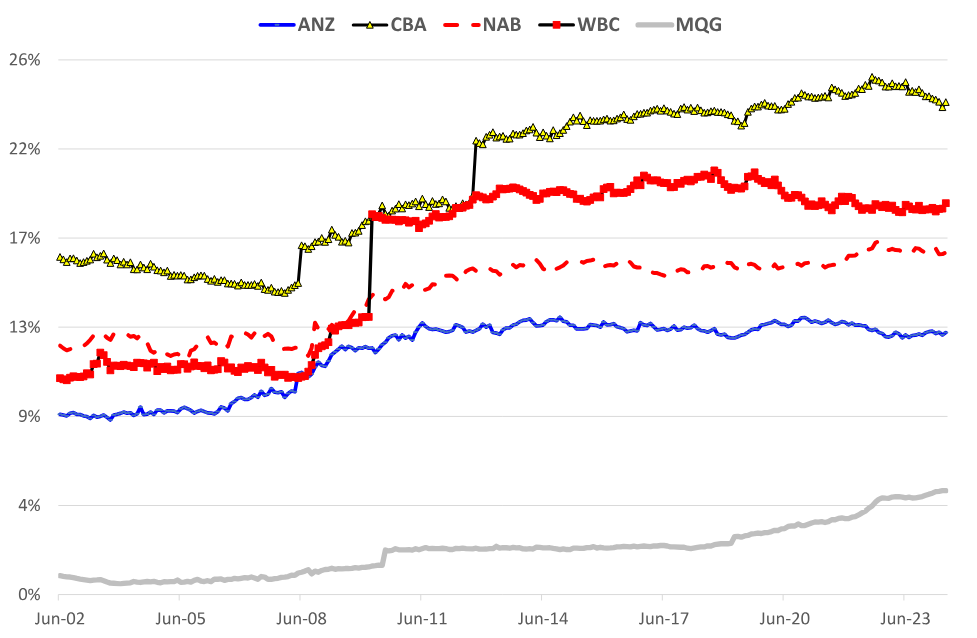

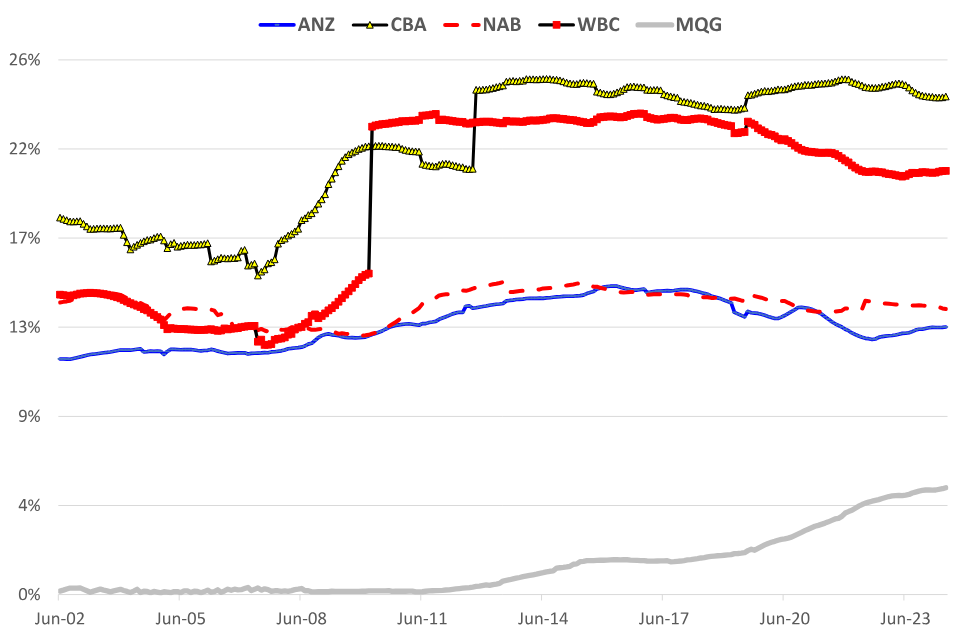

The NIM had fallen from 1.96 per cent in the March half last year to 1.94 per cent in the September 2023 half and to 1.89 per cent in the March 2024 half.

High-impact negotiation

masterclass

July 9 & 16, 2025

5:00pm - 8:30pm

This high-impact negotiation masterclass teaches practical strategies to help you succeed in challenging negotiations.

NIM was 1.92 per cent in this June quarter, a solid showing during a period in which the bank - doing things differently – priced to win, set out to secure above system growth on both sides of the balance sheet and above to grow market share.

Following the lead of Commonwealth Bank and NAB last week, Westpac have recognised an implausibly low impairment charge of around $100 million. The charge was $200 million in the two prior quarters.

Yet the ratio of stressed business exposures jumped in June to 2.9 per cent from 2.5 per cent.

These ratios are pronounced in two industries many would expect, given findings of many business surveys and ASIC insolvency trends, namely Wholesale & retail trade and Construction.

In retail trade the stressed ratio was 5.6 per cent at the end of June and 5.3 per cent in construction. One more industry of concern is Agriculture, forestry & fishing with a ratio of 5.5 per cent.

Stressed exposures right across the bank in June were 1.42 per cent, up 20bps in six months.

Still, the bank reduced provision coverage this quarter. This will need to be reversed and raised for the full year result.

This can safely be said about Westpac.

Westpac was a wreck. In fairness, Westpac these days is less than a wreck than it was in recent years.