Resolution Life may still on the hunt for a co-investor in its proposed - but shaky - acquisition of the Australian and New Zealand wealth protection and mature businesses of AMP.

As of late last week, a proposal was circulating aiming to draw in a locally-based investor able to fully exploit the value in the franking credits attached to any dividends that may be paid by the former life office, following a change in control.

That change in control - scheduled to occur by the end of September - is now being rethought by AMP and the privately-held Resolution in the face of disquiet on the part of the Reserve Bank of New Zealand.

Yesterday morning AMP suggested the deal may well fall over.

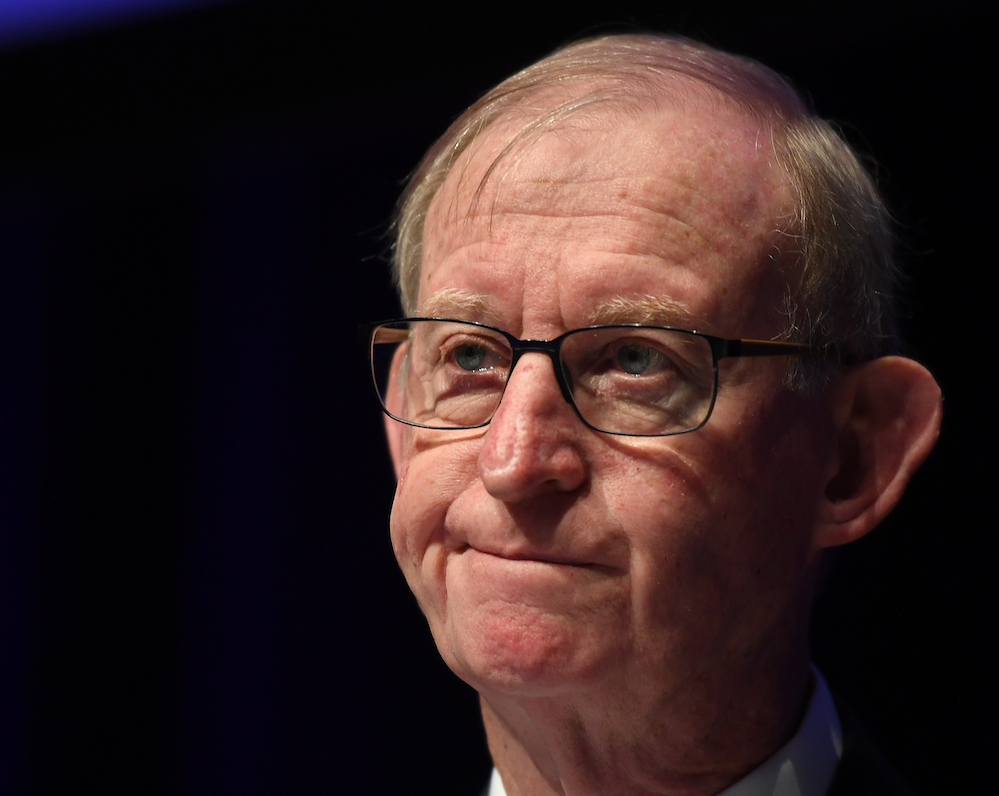

David Murray, AMP's chair, in a missive said that "the transaction is now highly unlikely to proceed on the originally agreed terms due to challenges in meeting the necessary regulatory approvals in New Zealand.

"We believe that achieving the New Zealand approvals would involve significant changes to the structure of the business, meaning the sale would no longer deliver a good commercial outcome for AMP and Resolution Life."

The buyer last night confirmed it's taking a commercial approach to salvaging the deal.

"Resolution Life reaffirms its strategic interest in expanding its in-force specialist life insurance business to Australia and New Zealand.

"Resolution Life views the acquisition of AMP Life as an excellent opportunity.

"As such, the two parties are now engaged in discussions regarding a restructuring of the transaction (including updated terms) to accommodate the regulatory requirements whilst delivering a de-risked transaction with execution certainty, which meets the needs of all stakeholders."

Murray made clear in his earlier statement that "if we cannot reach a transaction on acceptable terms, AMP will retain AMP Life."

Disclosure: the author is a policy holder with AMP.