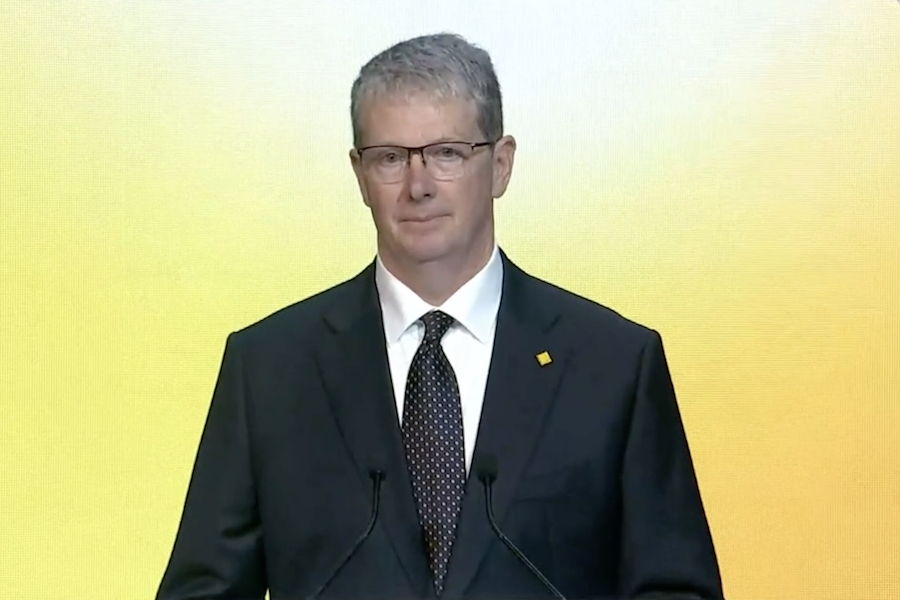

CBA chair Paul O’Malley

Commonwealth Bank chairman Paul O’Malley copped a grilling from shareholders on Wednesday as they voiced concerns over the company’s progress in meeting climate targets, its response to the PwC governance scandal and financial support for indigenous recognition in the Constitution.

At another carefully staged annual meeting in Sydney – in which the company restricted the involvement of shareholders trying to participate online – O’Malley had his work cut out responding to a volley of questions from erudite investors who attended in person.

When asked to explain whether he had any concerns about the quality of audits conducted on the company’s accounts since 2008 by PwC, O’Malley unequivocally described the firm’s work as “first class”.

High-impact negotiation

masterclass

July 9 & 16, 2025

5:00pm - 8:30pm

This high-impact negotiation masterclass teaches practical strategies to help you succeed in challenging negotiations.

"PwC provides independent audit advice, review and assurance services for the CBA,” he told shareholders.

“The quality that we have seen from PwC in relation to our accounts and the processes has been first class.

“We know that their files are reviewed by regulators from time to time and we know that PwC has had a very challenging time and has learnt from that time.

“I personally have had two meetings with their CEO to discuss their renewal program that has been publicly and transparently released.

“Clearly, like everyone, we were concerned at the developments, but the independence and the capability that we have seen from their audit team, I think works to the benefit of CBA.

“But we will always look at what developments occurred there and decide what decisions, if any, to make differently in the future."

CBA’s 2023 accounts were audited in August by PwC partner Elizabeth O’Brien.

Part of PwC’s responsibilities was to assess whether the bank’s home loan book was compliant with responsible lending laws and other regulations.

In response to a query from a shareholder, O’Malley confirmed that PwC had completed that work as part of the 2023 audit.

“The PwC audit is undertaken with a systematic methodology that takes deep dives on the mortgage book,” he told the meeting.

“That’s my understanding.”

O’Malley did not comment on one shareholder’s assessment that PwC had “sold out every Australian” when it shared confidential tax reform information with its clients.

The CBA chairman spent most of the meeting responding to shareholders who disagreed with the bank’s decision to donate A$2 million to the “Yes” campaign for the upcoming referendum on indigenous recognition in the Constitution.

At least five shareholders panned the board for taking a position on what they described as a “political issue”.

One shareholder demanded to know how each director voted on the board resolution on whether to commit funds to the Yes campaign.

The shareholder wanted those who supported the motion to be removed from the board.

While O’Malley refused to identify the voting decisions of each director on the resolution, later in the meeting one board member Simon Moutter told the meeting he wanted to put on the record his support for the Voice to Parliament.

CBA has been actively involved in consultations with First Nations’ communities on the prospect of constitutional recognition since 2014.

O’Malley rejected suggestions that the bank’s official support for the Yes campaign could be seen as a political act.

“We see this as long-term commitment to recognition,” he told the meeting.

“We do not see this as a political item – it’s a policy item.”

O’Malley said that giving indigenous people a voice was better for every Australian.

“We have a longstanding commitment to supporting First Nations people,” he said.

“I, for one, am proud of the work the bank has done.

“We will continue to focus on the steps in our reconciliation plan.

“It helps us to engage with our communities and support them.

“We will be inclusive of everyone, and we will stick to that focus over time.”

Shareholders and environmental activists fired a string of questions regarding the bank’s progress in meeting its climate change targets.

CBA has publicly stated its commitment to reducing its financial emissions in thermal coal mining to zero by 2030.

It is also committed to the targets of the Paris Agreement and aligning its lending activities to support Australia meeting its net zero emissions by 2050.

Climate lobby group Market Forces was less prominent at this year’s meeting, but a spokesperson openly panned CBA for removing a requirement for existing thermal coal producers to furnish the bank their transition plans.

The bank’s chief executive Matt Comyn told the meeting that the requirement had been removed because CBA’s exposure to thermal coal producers had reduced to a modest level.

On the bank’s exposures to producers of metallurgical coal, O’Malley said the transition to renewable energy for supporting steel production was more complex.

“There’s not yet at scale a viable replacement for metallurgical coal in steelmaking,” he said.

“We have reasonably low exposure to that (metallurgical coal borrowers) at the moment.

“I think we’ve got the right framework to ensure we can meet our climate commitments.”

High-profile shareholder activist Stephen Mayne pilloried the bank for not taking questions directly from shareholders who were following the meeting online.

He also quizzed the bank on its decision to move away from the practice of allowing online meeting participants from voting on resolutions.