Lower caps on interchange or even the elimination of interchange in payments networks are on the horizon as the Payment System Board commences its Review into Retail Payments Regulation.

This Review will examine the costs merchants face when accepting card payments and the framework for surcharging.

The RBA yesterday released an Issues Paper, inviting stakeholders to provide detailed feedback on the current regulatory framework and to suggest potential regulatory responses. This will be the precursor to further rounds of consultation before introducing new regulations, or modifying current ones.

The RBA has a wish list of reforms, expressed in the issues paper by the phrase, “is there a case for …?”

The chief reforms on the RBA’s mind appear to be:

• lowering the level of interchange benchmarks or caps and limiting the difference between the interchange fees paid by big and small businesses.

High-impact negotiation

masterclass

July 9 & 16, 2025

5:00pm - 8:30pm

This high-impact negotiation masterclass teaches practical strategies to help you succeed in challenging negotiations.

• reducing the complexity, and/or enhancing the transparency of interchange fees.

• greater transparency of scheme fees to promote efficiency and competition, and adjunct action to reduce the complexity or growth of scheme fees.

• greater transparency of fees, wholesale costs and market shares for some payment services

• banning or capping surcharging

The latter is already copping most attention in mass media, but it will be interchange reform that is needed to drive down merchant fees.

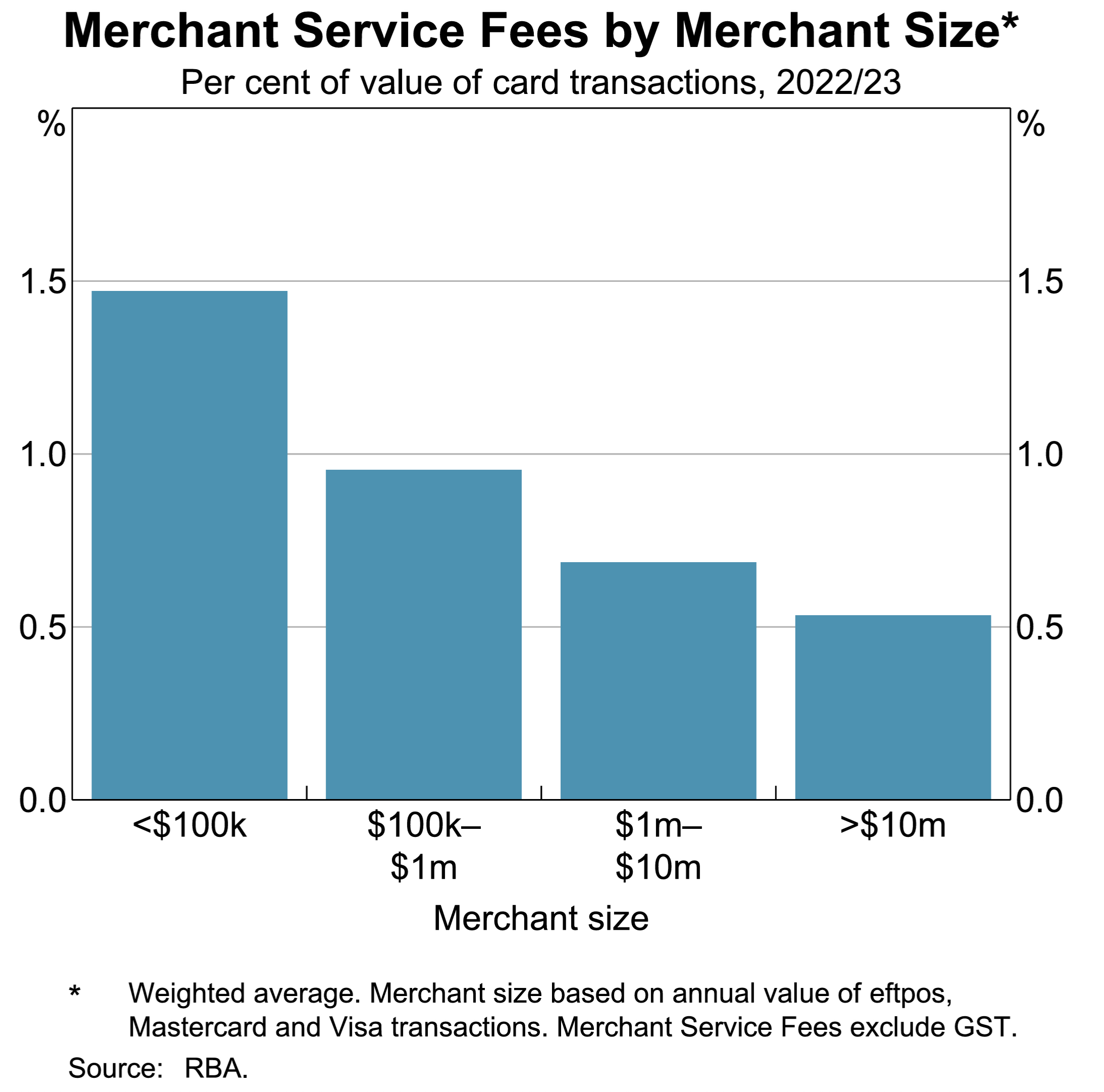

Some small merchants are paying fees of more than 2.5 per cent on card payments and the disparity in MSFs by merchant size – by a factor of three – is stark.

Interchange fee schedules have become more complex over time, the Issues Paper notes.

“The increase in the number of interchange categories has been associated with developments including the introduction of new infrastructure, such as tokenisation, the introduction of new products, such as instalments programs and responses to competition, such as special rates for small and medium businesses.

“While varying interchange fees could be useful for incentivising certain behaviour from acquirers and merchants, such as encouraging tokenised transactions online, the case for differentiation is not always clear.

“For example, it is not obvious why interchange rates should be higher for in-person transactions when using a mobile wallet rather than a physical card or why interchange rates need to be higher for online transactions.

“Interchange fee complexity makes it hard for merchants on unblended plans to understand and check their costs, and compare service fees across providers, which may hamper competition.”

The RBA also called out, once more, its frustration at the languid pace of adoption of least cost routing.

The RBA said it was interested in views on “whether a formal regulatory requirement is warranted for LCR for in-person transactions (excluding mobile wallets), particularly given the progress that has been made to date.

“For example, PSPs could be required to enable LCR for all merchants by default, with merchants able to opt out if they wish.”

Stakeholder feedback on LCR for online transactions and mobile wallet transactions will be sought in a future phase of the Review given that any formal intervention in these areas would benefit from the passage of [legislative] reforms.

“Any formal regulatory requirement would probably need to extend to a broader range of PSPs to be effective, such as payment gateways and mobile wallet providers, where there is uncertainty as to whether they are within the scope of the existing PSRA.”

The government won’t be waiting for the RBA and Payments System Board to follow the letter of the law on regulatory reform.

“We will introduce a ban by the beginning of 2026 on debit card surcharges” Stephen Jones, the assistant treasurer said.

“If the banks, the payment system providers, the card operators don’t get it right and don’t knock this on the head themselves, then we are willing to move ourselves and using the levers available to us to ensure that these debit card surcharges are ended.”