RBA assisstant governor Chris Kent

The Reserve Bank of Australia’s Term Funding Facility - a bedrock of industry funding from March 2020 to June 2024 – has been branded “effective” by the RBA in its Review facility, published yesterday.

The Reserve Bank’s package of unconventional monetary policy measures, introduced in March 2020 at the outset of the Covid-19 pandemic, has copped its (mostly unfair) share of criticism, especially in hindsight. Other measures alongside the TFF included the bond purchase program and yield curve control.

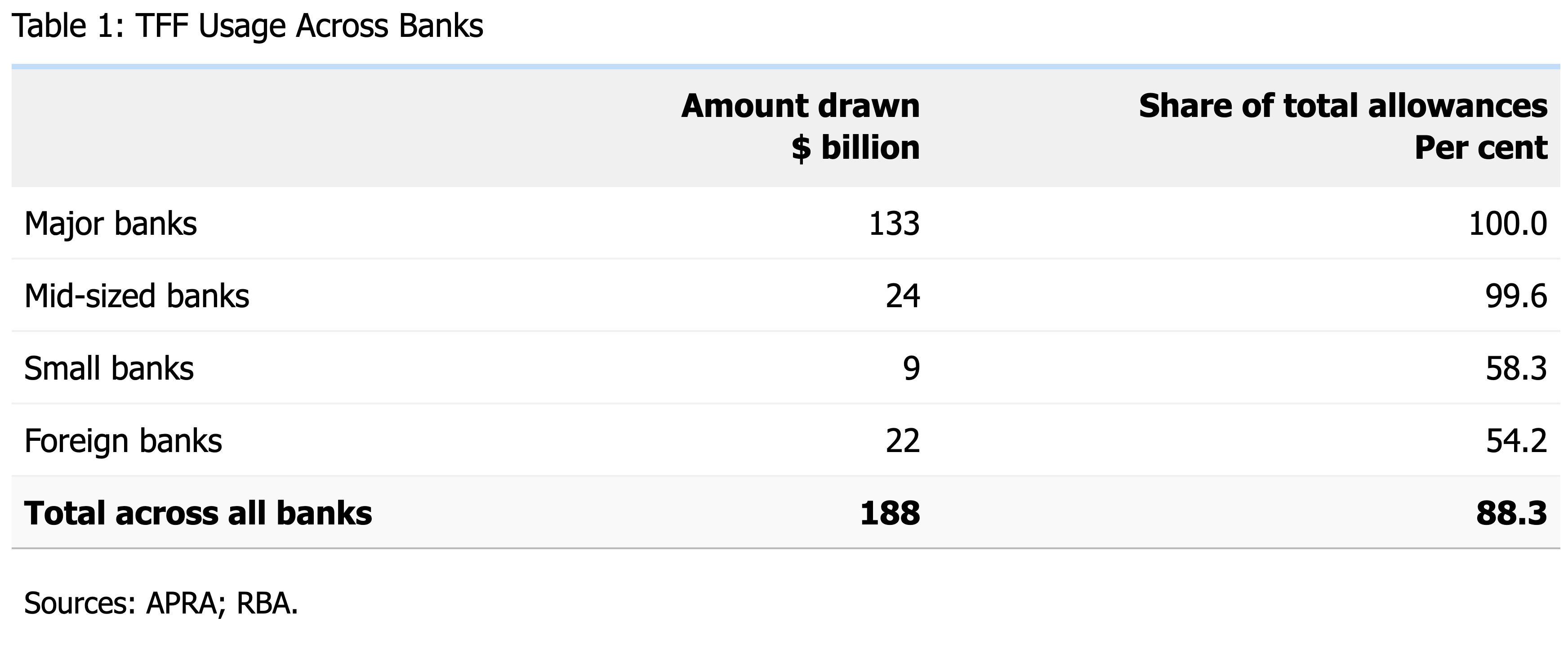

The TFF ultimately provided $188 billion of funding to the industry, which was equivalent to 6 per cent of the stock of credit outstanding at the peak of the TFF’s use.

Banks repaid all TFF funds as scheduled by mid-2024 without incident.

The Review of the TFF is the final of four reviews released by the RBA into these pandemic-era measures (with the fourth relating to Forward Guidance).

“Overall, the TFF was effective in keeping credit flowing to the economy and in stimulating aggregate demand, as well as contributing to restoring confidence in financial markets” the review argues.

“A facility of this type should be considered again if circumstances warranted it” the RBA said in concluding observations from this comprehensive review.

From the point of view of banks it was the Term Funding Facility that was most relevant, and novel, of all the unconventional monetary policy measures.

Mid to late March 2020 was “a time when wholesale funding markets had been significantly disrupted” the review reminds readers. Projections for deterioration in the labour market were also alarming at this time.

The goals of the TFF were twofold:

First, “to reinforce the benefits to the economy of a lower cash rate, by reducing banks’ funding costs and in turn helping to reduce borrowing rates”, and

Second, “to encourage banks to lend to businesses, particularly small and medium-sized enterprises.”

At the time, and throughout most of the four year life of the TFF, there was doubt that the facility was doing all that much to underpin lending for businesses, while competitors such as non-banks argued that it was little more than cheap funding for banks.

This review demonstrates that the cynics were wrong:

“There is evidence that total business credit rose by more than would have been the case absent the TFF … it provided important support for businesses” the review argues.

Notably, “business credit did not decline as had been the case in previous sharp economic downturns.

“Some banks increased their lending to SMEs and received additional funding from the TFF in line with this incentive.”

But, “business lending overall was little changed over the TFF drawdown window in an environment of soft demand for business finance - with businesses’ cashflows boosted by government support.”

There is plenty in the review for banks’ managements, and especially banks’ treasuries, to ponder.

Out of necessity (given haste) on the RBA’s side, the Reserve Bank selected a design that would make the most of the existing collateral arrangements in the repos market.

Thus those banks with established self-securitisation programs were better placed to maximise their use of the Term Funding Facility. Smaller banks, which will have included many credit unions (and lacked such programs, at least at the outset), made relatively modest use of the TFF as a result.

One of the highlights of this review is that it shares new data on the utilisation of the TFF by different categories of bank. Unsurprisingly, major banks maximised their use of the TFF, while they also gamed APRA’s rules on liquidity management (in relation to undrawn components).

“Would the RBA use a term-lending tool again in the future?”

“Would the RBA use a term-lending tool again in the future?”

Christopher Kent, the RBA’s assistant governor (financial markets) posed the essential question at the end of his speech explaining the findings of the review at RBA HQ in Sydney yesterday.

“The board would consider such a tool in extreme circumstances when the cash rate target had been lowered to the full extent possible” Kent said.

“But it would do so only after consideration of a wide range of scenarios and the associated risks, and with a broader range of operational options than were available at the time of the pandemic.”

One critical “operational option” available now, but not in early 2020, is the ability of both the RBA and banks to price any future TFF flexibly.

“Floating-rate term-lending would have been challenging for both the RBA and the commercial banks to adopt in early 2020, because neither the RBA nor the banks were readily able to undertake floating-rate repos” Kent said.

“The RBA and the banks have since upgraded systems and now have the capacity to easily undertake either floating or fixed-rate repos.”