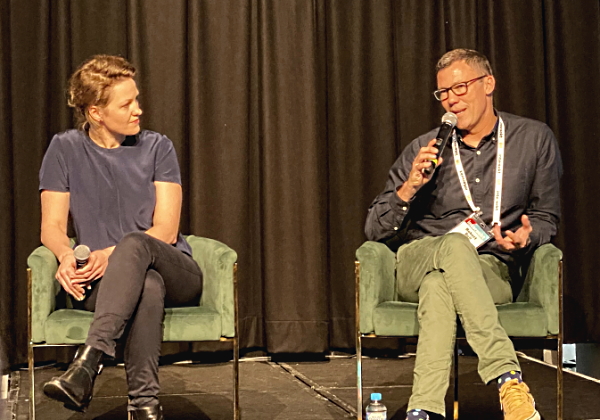

UBank buddies Philippa Watson (L) and Robert Bell

UBank buddies Philippa Watson (L) and Robert Bell

UBank will be the continuing brand for the amalgamated 86 400 and UBank digital banking business of NAB.

A packed penultimate session at the Intersekt Festival in Melbourne yesterday heard from Philippa Watson, UBank's chief these last 12 months, and 86 400's CEO Robert Bell outline implementation plans for the reboot of UBank under the former neobank's sharp and ambitious user experience.

The transaction for NAB's purchase of 86 400 from Cuscal closed on Wednesday.

"For a period of time, we’ll have two distinct brands in public," Watson told the forum.

"[Later], you'll see a new bank that looks and feels like 86 400."

UBank has more than 600,000 customers, Watson said.

High-impact negotiation

masterclass

July 9 & 16, 2025

5:00pm - 8:30pm

This high-impact negotiation masterclass teaches practical strategies to help you succeed in challenging negotiations.

Bell explained to the fintech diehards that "there's not much point if we only help a small number of people.

"As successful as 86 400's been in a significant period of time, we only just tip over 100,000 [customers]. We need to reach more people."

As enthusiastic as ever, Bell told the crowd that "we haven't slowed down our approach at all. 86 400's been built to scale.

"We've already seen some of our tech copied by one of the largest banks in Australia," a reference to the connected accounts feature in the 86 400 app.

Watson explained: "We have to prepare the protocol, so as many UBank customers will move across [to the refreshed experience] as possible.

"We will provide the opportunity for customers to move over to a new bank we created

"NAB's desire is to build a world leading digital bank.

"From today our teams are starting to work together in an unrestricted way," she said.