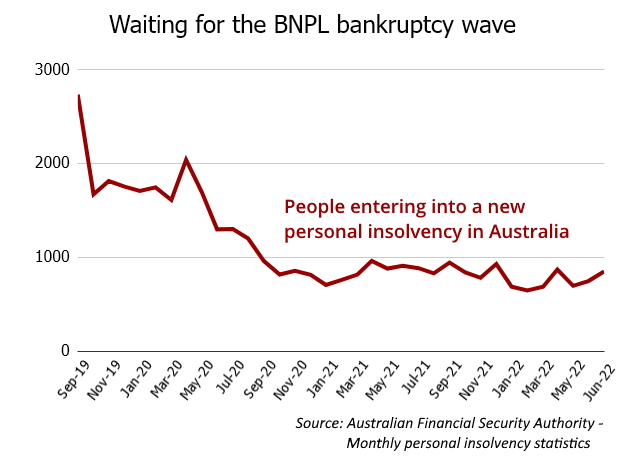

Personal insolvency numbers fell 10 per cent over the year to June, with bankruptcy and debt agreement numbers at historic lows.

The Australian Financial Security Authority reported 9545 new personal insolvencies in the 2021/22 financial year – down 10.1 per cent on the previous year.

There were falls in all states and territories except Tasmania, which recorded an increase of 13 per cent.

Of new insolvencies, 63 per cent were bankruptcies, 36 per cent were debt agreements and the rest were personal insolvency agreements and insolvent deceased estates.

AFSA chief executive Tim Beresford said in a statement that there was a small pick-up in the June 2022 quarter, when there were 2301 new personal insolvencies – up from 2215 in the March quarter.

Insolvencies influenced by a bankrupt’s association with a construction businesses increased by 32 per cent in June, increased by 29 per cent for those linked to retail trade and lifted by 25 per cent in accommodation and food services.

Beresford said AFSA is expecting a return to pre-pandemic insolvency levels over the next couple of years.

The recent peak in personal insolvencies was in 2017/18, when 32,299 people entered personal insolvency – more than three times the number recorded last financial year.