Source: Redbridge Consulting

Source: Redbridge Consulting

A whopping 78 per cent of mortgaged households polled by Redbridge Consulting say they will experience either “a great deal of stress” or “some stress” in the event the RBA were to hike the cash rate a further 25 basis points.

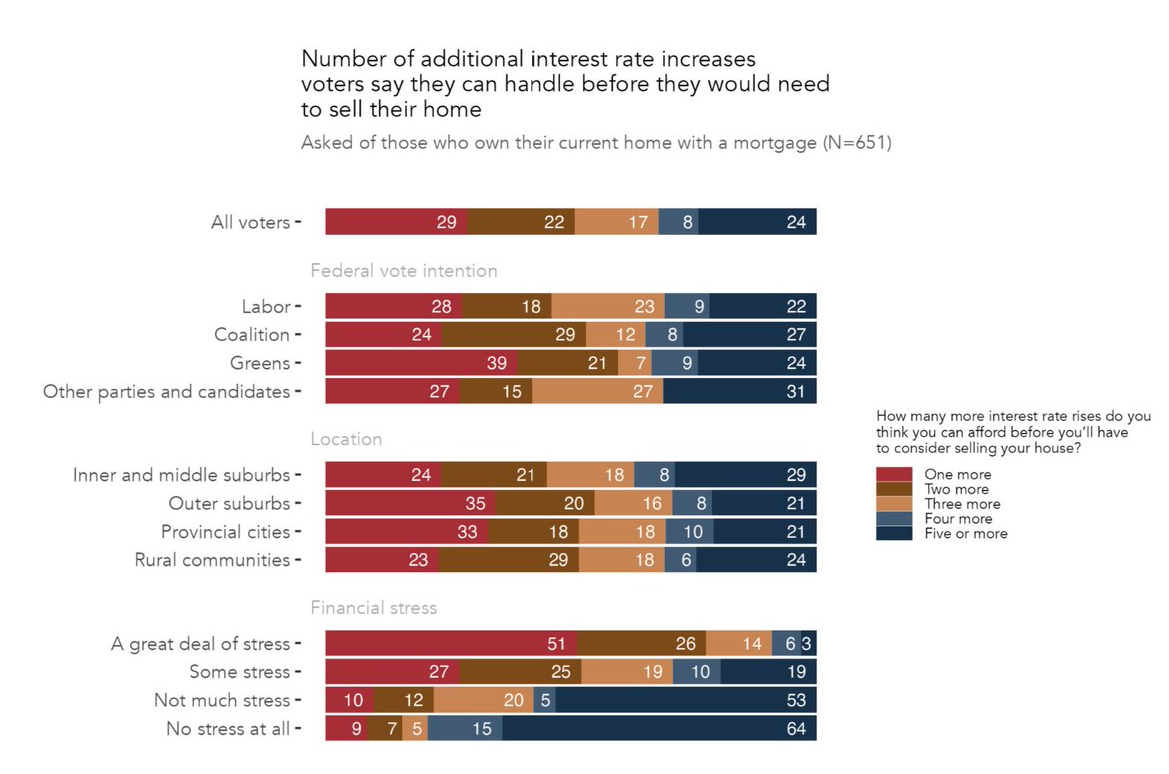

Research released yesterday by Redbridge asked respondents with a mortgage how many more interest rate increases they could handle before they would need to sell their home.

Of all voters, just one such rise would tip 29 per cent over the edge.

Two rate rises would drag down 51 per cent of respondents.

S&P Global Ratings latest report on mortgage arrears on home loans funded via mortgage-backed securities inevitably shows a deterioration over the March 2024 quarter.

As of March 2024, prime RMBS arrears were at 1.00 per cent, up from 0.95 per cent a year earlier.

Stay Ahead. Stay Informed.

Concise. Candid. Provocative.

Get the daily banking news that matters from the industry's most experienced insiders.

Nonconforming arrears hit 4.18 per cent over the quarter, up from 4.02 per cent at the end of December 2023.

“Nonconforming arrears will continue to grow faster than prime arrears, given the sector’s greater sensitivity to weaker economic conditions. Property price growth will help to minimise losses”S&P said.

Investor arrears were at 0.77 per cent at the end of March, compared with 1.12 per cent for owner-occupiers.

"While we expect both investor and owner-occupier arrears to increase, investor arrears increases are likely to be buffeted by higher rentals to some extent” S&P said.

“We can tell some age groups are really struggling” Sarah Hunter, the RBA’s chief economist told an investor forum yesterday.

“Household consumption is still pretty soft” she said, as evidenced by the most recent data on retail spending.

Steven Kennedy, secretary to the Treasury, made much the same point in a post budget speech yesterday.

“In response to inflation and higher interest rates, households have pulled back on discretionary spending.

"Household consumption was broadly flat over the past year, and in per capita terms, it fell.

“The contribution of household consumption to growth was the weakest in the past decade outside of the pandemic. And weak retail trade data suggest this outcome is likely to continue into the first half of this calendar year.”

Meanwhile NAB this morning said that demand for interest free loans via its partnership with

Good Shepherd were up 19 per cent on the previous year, as Australians face cost of living pressures.

More than 42,000 no interest loans have been issued in the past year by Good Shepherd, with families have overtaking individuals when it comes to demand for no interest loans.

More than $68 million in no interest loans was issued over the year, up from $57 million.

“More no interest loans were issued to 35-39 year olds than any other age group” NAB said.

Household essentials were the main reason for seeking a no interest loan, followed by vehicle and transport costs.

The No Interest Loans Program is funded by the federal government and state governments, with capital funding by National Australia Bank and delivered to eligible Australians via Good Shepherd Australia New Zealand.