Source: Qi Insights and RBA data

By Peter Drennan, Senior Business Analyst, PayDay News

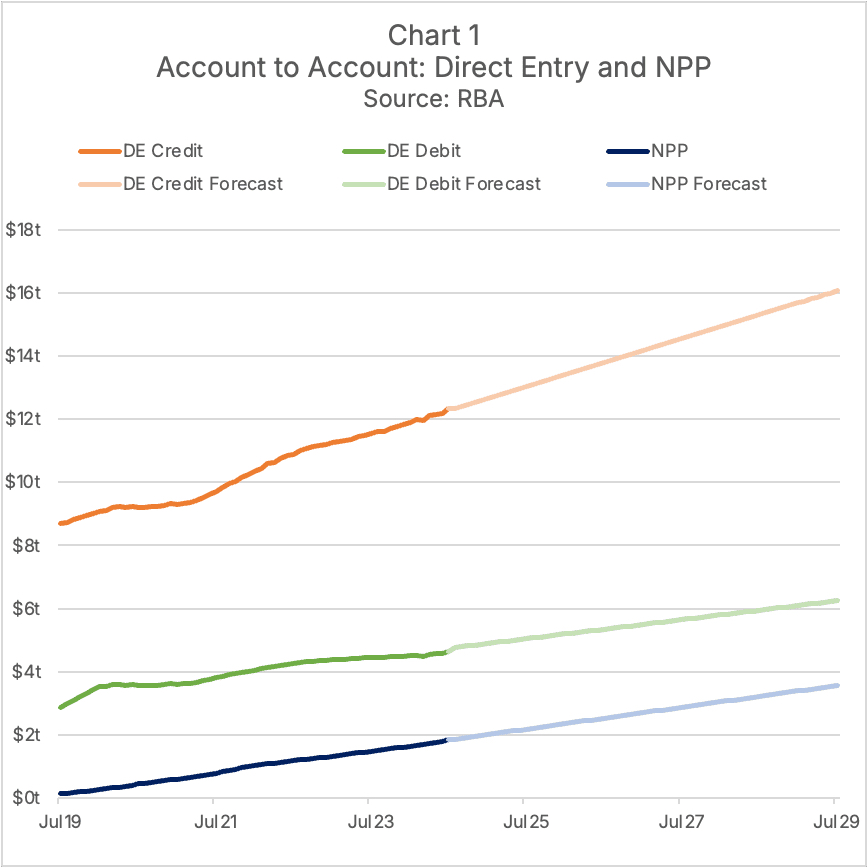

With only five years to run until the proposed closure of the Bulk Electronic Clearing System (BECS), the New Payments Platform has just 10% of Account-to-Account (A2A) payments.

A2A payments are a massive market, with $18.8 trillion in annual volume across 5 billion transactions each year. The bulk of that comes through the direct entry system, which is used for bulk or batch-processed payment transfers between deposit accounts. That includes AusPayNet’s BECS.

Direct Entry credit makes up the bulk, at over $12 trillion in payments annually. The newer technology, New Payments Platform (NPP), has been in the market for just over 5 years and has volume at just under $2 trillion. That represents 10% of total A2A volume going through NPP.

It is worth a note that this is distinctly different from Retail Payments including cash and card; this review is a look at account transfers and the systems that facilitate it. It even includes payments made by the RBA itself; it is big volumes!

Source: Qi Insights & RBA

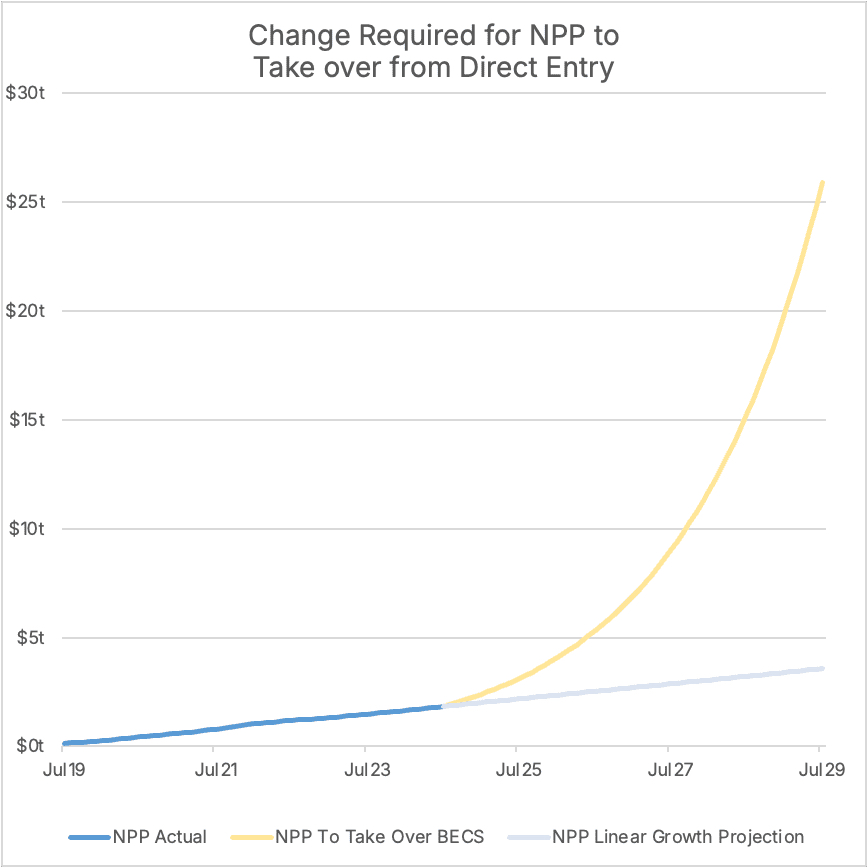

Payments commentator and Independent Payments Forum co-founder Brad Kelly said, in order for BECS to be retired by 2030 it needs to grow at 1400% with a CAGR of 70%.

“It’s almost impossible for BECS to be retired by 2030 from a technical and business perspective” Kelly said.

“In terms of retail, debit cards are going to be around for many more years and we need to get the regulation right there, to ensure we have a fair and reliable system that for everyone. The focus needs to be on what we can do today.”